ACCESS BANK

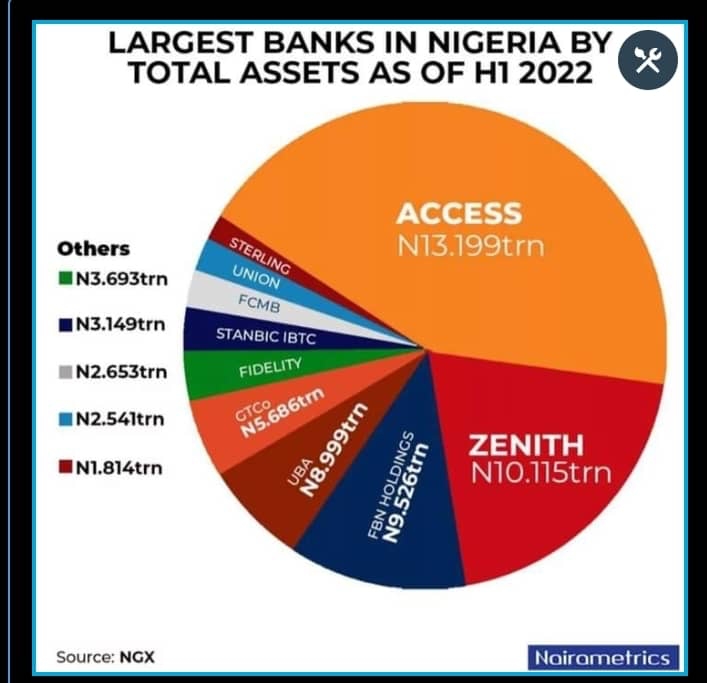

Access Bank Plc has earned a spot as the largest bank in Nigeria by total assets of 13.199trillion naira in the first half of 2023.

The tier-one banks surveyed recorded an aggregate total asset value of N13.199 trillion in the first half of 2023.

Access Bank’s total assets stood at N20.85 trillion at the end of June, representing a 30 percent share of the total assets of the tier-one banks surveyed.

Zenith Bank

Zenith Bank’s total assets rose to N10.115 trillion in the first half of 2023, a 58.4 percent increase from 5.12 trillion recorded in the same period of 2022.

The bank’s total liabilities amounted to N14.25 trillion in the first half of 2023, from N8.84 trillion recorded in the same period of 2022.

Total shareholders’ equity amounted to N1.78 trillion in the period under review from N1.27 trillion in 2022.

Zenith Bank Plc is a financial service provider in Nigeria and Anglophone West Africa. It is licensed as a commercial bank by the Central Bank of Nigeria, the national banking regulator.

United Bank for Africa (UBA)

United Bank for Africa’s total assets grew by 70.9 percent to N15.38 trillion in the first half of 2023 from N9 trillion recorded in 2022.

The bank’s total liabilities increased to N13.67 trillion from N8.21 trillion in the period reviewed.

UBA’s total equity amounted to N1.7 trillion, from N0.79 trillion recorded in 2022.

United Bank for Africa Plc is a Multinational pan-African financial services group headquartered in Lagos and known as Africa’s Global Bank. It has subsidiaries in 20 African countries and offices in London, Paris, and New York. In December 2021, UBA received its banking license to commence operations in the UAE.

First Bank of Nigeria Holding Company

FBN recorded N14.18 trillion as its total asset in the first half of 2023 from N9.53 trillion recorded in the same period of 2022.

Total liabilities amounted to N12.8 trillion from N8.64 trillion recorded in the same period of 2022.

Total equity grew by 55 percent to N1.38 trillion from N0.89 trillion recorded in the same period of 2022.

Guaranty Trust Holding Company (GTCO)

Guaranty Trust Holding Company’s total assets stood at N8.51 trillion in the first half of 2023, up 49.5 percent from N5.69 trillion recorded in 2022.

The holding company recorded total liabilities which stood at N7.31 trillion from N4.84 trillion in the period reviewed.

Total equity amounted to N1.20 trillion in December 2022 from N0.85 trillion recorded in 2022.

Guaranty Trust Holding Company PLC also known as GTCO PLC is a multinational financial services group, that offers retail and investment banking, pension management, asset management and payments services, headquartered in Victoria Island, Lagos, Nigeria